Studies show that ChatGPT can outperform financial analysts. ChatGPT financial statement analysis can make the analyze financial statements, remove a ton of bloat, assess risks, and finally give you a narrative prediction about the future. Use AI for financial analysis and get a second opinion before you make a decision.

Update! Google Gemini could be even better model for financial analysis with it’s massive 2 million token context window.

Three interesting studies I found were from the same three guys Alex G. Kim, Maximilian Muhn, and Valeri Nikolaev from University of Chicago Booth School of Business. The authors of the fourth study are Van H. Pham and Scott Cunningham from Baylor University.

Can ChatGPT analyze financial statements? Yes! Check out the studies and the ChatGPT financial statement analysis template prompt. Below I will also give you some ChatGPT financial forecast examples.

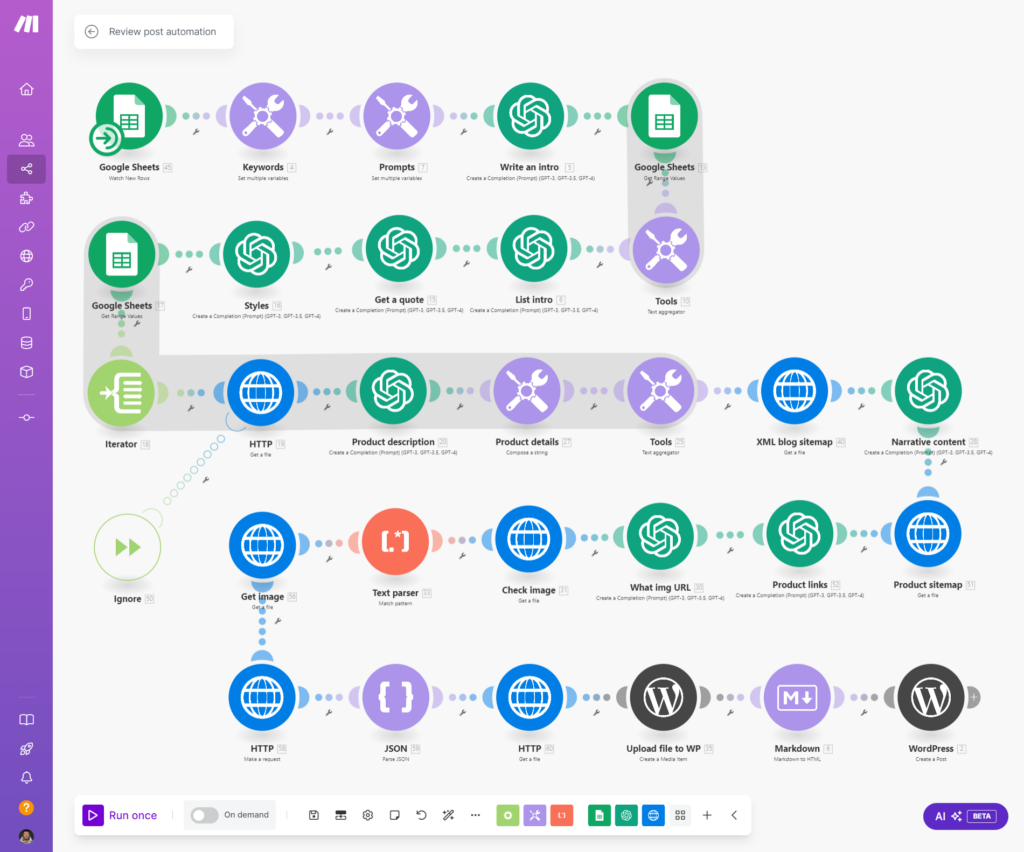

ChatGPT financial analyst prompt

How to use ChatGPT to analyze financial statements? If you want full details about the studies check out the links below. But just so you can test it out I combined the info from the “prediction” and “financial analysis” studies into one prompt you can use as a starting point. The cool part is you don’t need a special financial statement analysis AI tool, study finds special tools are not better.

Here goes ChatGPT for finance PDF prompt:

We have a play where a CEO is presenting an earnings call. In the attached document you have the part of the play where the company explains their last quarter.

Take on the role of a financial analyst whose task is to perform financial statement analysis and complete the play based on specialist knowledge.

* Identify notable changes in certain financial statement items.

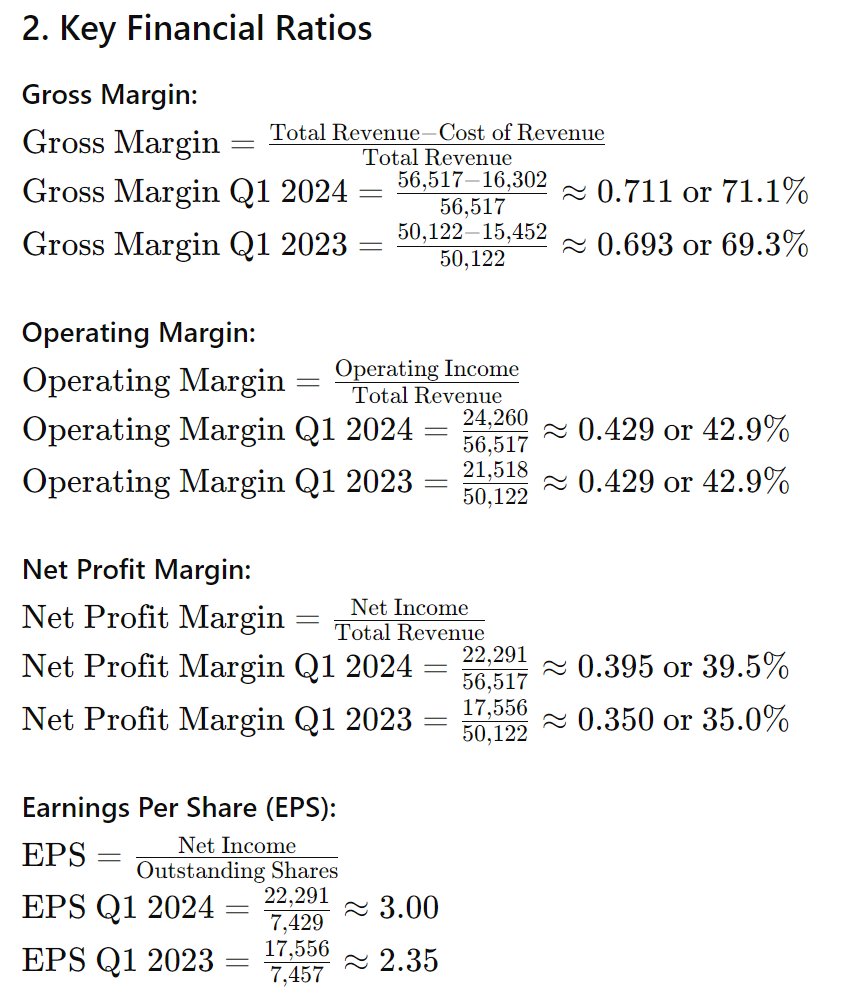

* Compute key financial ratios without explicitly limiting the set of ratios that need to be computed. When calculating the key financial statement ratios, show the formulae first, and then perform simple computations.

* Provide economic interpretations of the computed ratios.

* Use the basic quantitative information and the insights that follow from it to predict whether earnings are likely to increase or decrease in the subsequent period.

* Provide the predicted magnitude of earnings change (large, moderate, and small) and the confidence in your answer.

* Write a paragraph that elaborates your rationale.

After the earnings call the price of the stock changes. Now you have to write a scene where the CEO in play explains to investors what’s going to happen to the price of the stock in the next 12 months. He explains it by listing each month separately starting from [ENTER YOUR MONTH AND YEAR]. Stock price in [DATE] is [PRICE]

You can add this to the prompt. But it will make the prediction more cautious:

* Consider how political, ESG, and technology related risks may influence future performance. Note increases in R&D or capital investments for tech risk mitigation, changes in operational costs due to ESG risks, and adjustments in leverage or liquidity from political uncertainties. Use these insights for a nuanced prediction of future earnings and stock price movements, reflecting the comprehensive risk landscape.

I used MSFT as an example as this is on of the investments when considering investing in AI stocks. You can get MSFT financial data from here.

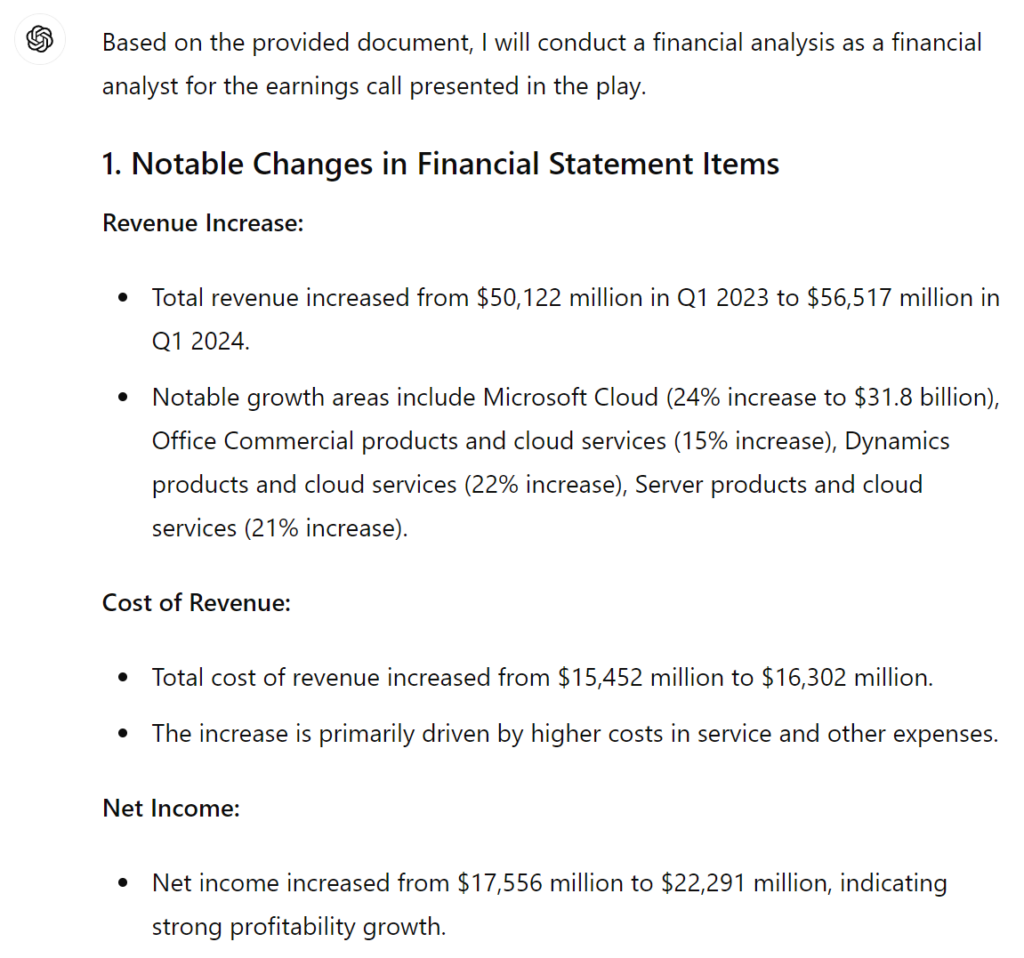

ChatGPT financial statement analysis results

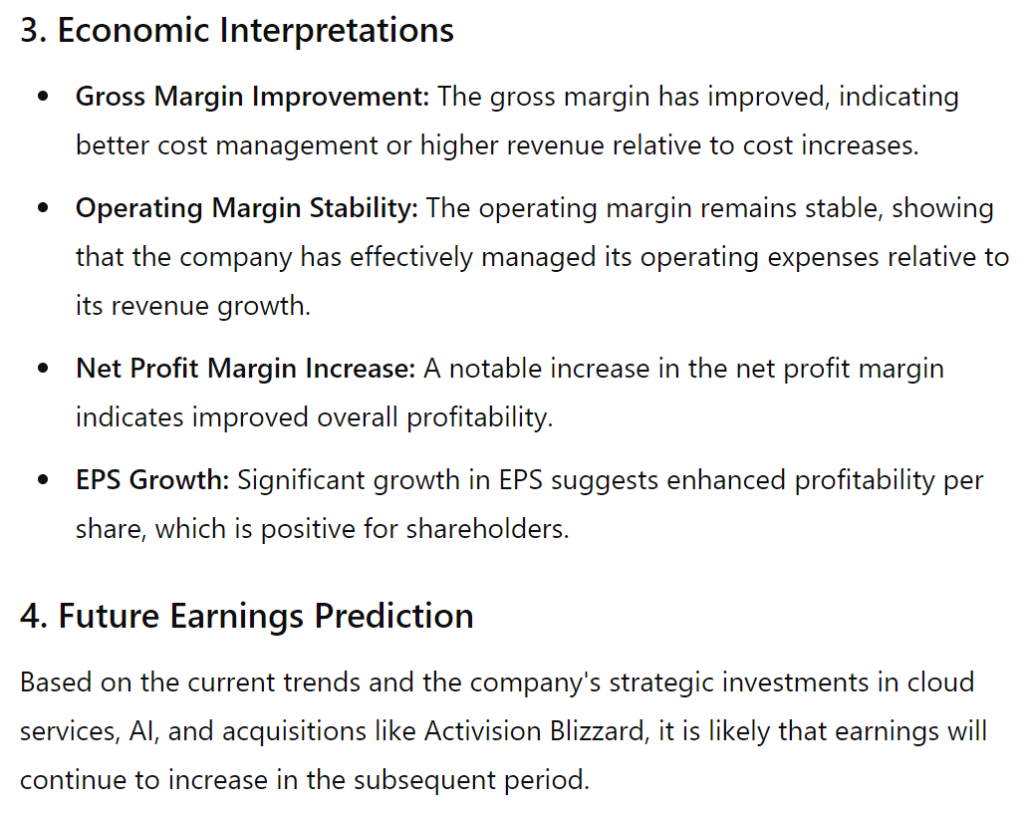

There result of one of the first financial analysis I made of MSFT reports is below. I gave ChatGPT information from 2023 to figure out how it would predict the price movements for 2024. ChatGPT financial statement analysis PDF of Microsoft form 10-Q (For the Quarterly Period Ended September 30, 2023):

Here are some more MSFT predictions from April 2024 to October 2024

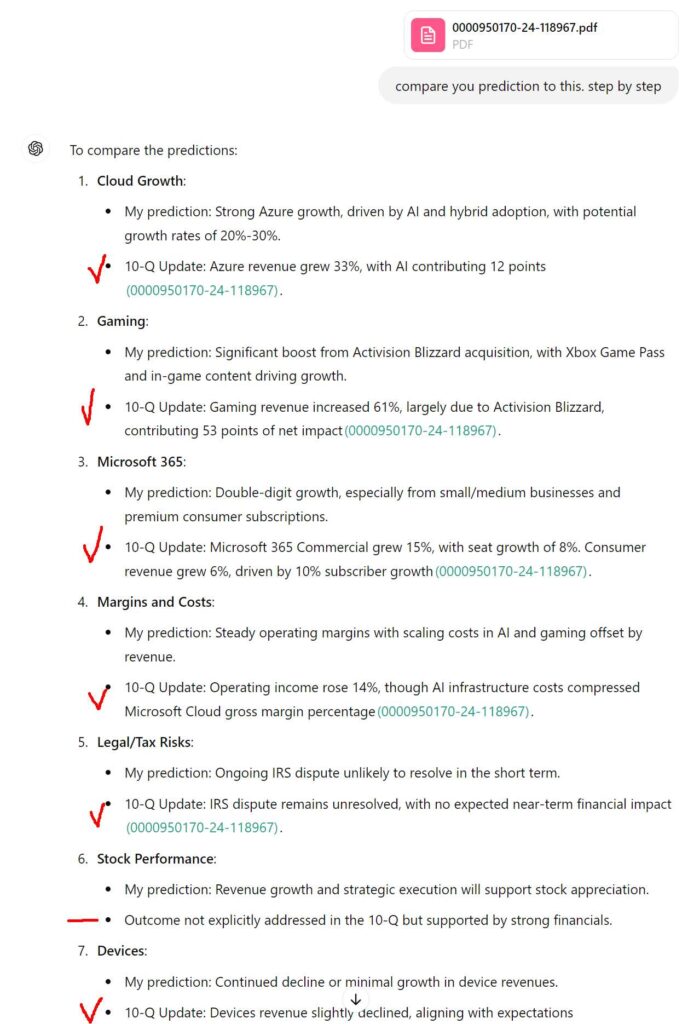

and its prediction for the next 6 months from November 2024.

JPMorgan launches in-house AI-based research analyst

JPMorgan Chase rolled out its generative AI product, LLM Suite, capable of performing research analyst tasks. An internal memo seen by the Financial Times states that this large language model aids in

- writing,

- idea generation, and

- document summarization,

and is currently used by about 50,000 employees, or 15% of the staff. Executives described LLM Suite as a “ChatGPT-like product” for general productivity, complementing apps like Connect Coach and SpectrumGPT. Developed in-house to meet regulatory requirements, it avoids consumer AI chatbots such as Anthropic’s Claude, OpenAI’s GPT, or Google’s Gemini. Generative AI in banking, president Daniel Pinto valued the bank’s AI technology at $1bn to $1.5bn. This initiative is among Wall Street’s largest LLM use cases, following Morgan Stanley’s partnership with OpenAI for wealth management.

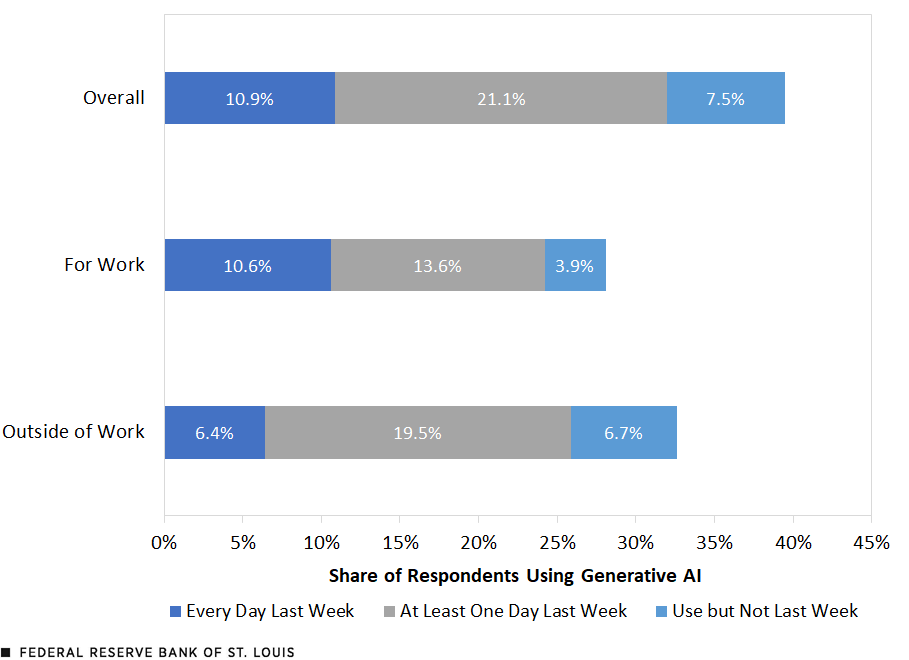

How people use AI for financial advice?

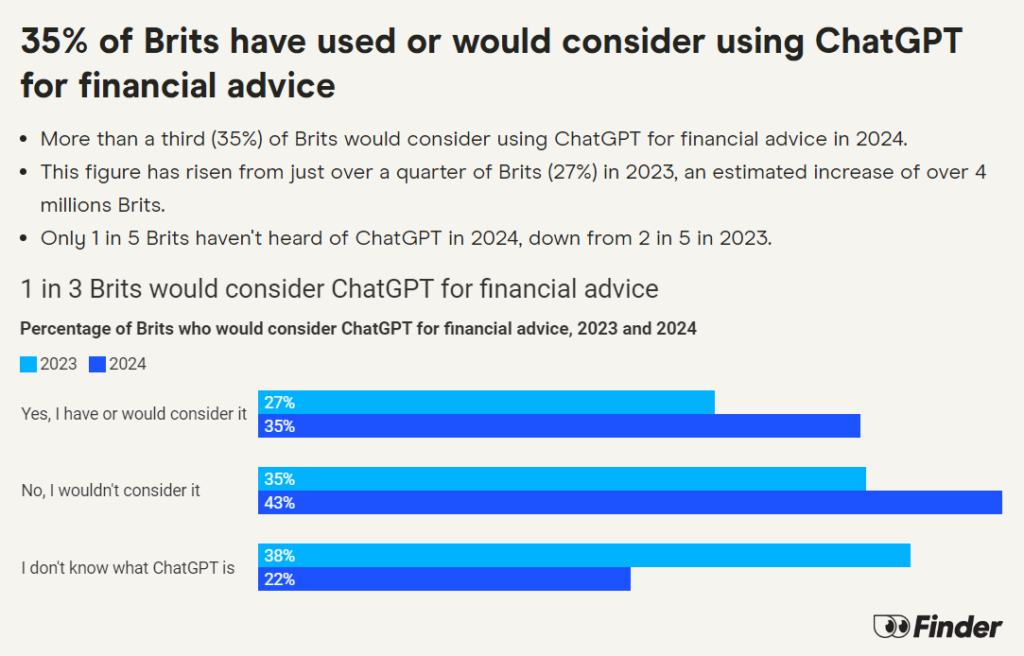

35% of Brits plan to use ChatGPT for financial advice in 2024. This is up from 27% in 2023, an increase of over 4 million people. In 2024, only 1 in 5 Brits haven’t heard of ChatGPT, down from 2 in 5 in 2023.

Use AI for Financial Analysis with ChatGPT

Study: Financial Statement Analysis with Large Language Models

I found this interesting study where researchers wanted to see if a large language model (LLM), could analyze financial statements as well as, or even better than, professional human analysts.

They gave standardized and anonymous financial statements to GPT-4 and asked it to analyze them to predict the direction of future earnings. Interestingly, even without any extra narrative or industry-specific information, GPT-4 outperformed human financial analysts in predicting earnings changes. This was especially true in situations where human analysts usually struggle.

GPT-4’s prediction accuracy was comparable to that of a state-of-the-art machine learning model that was specifically trained for this. The LLM’s success didn’t come from just remembering information from its training data. GPT-4 generated narratives about a company’s future performance.

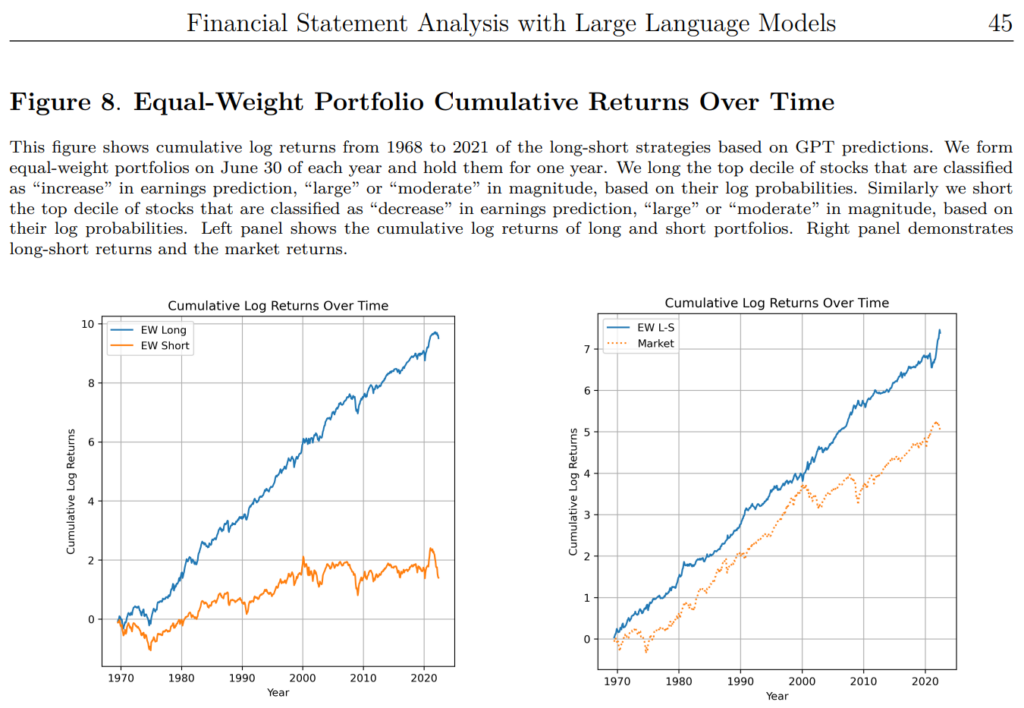

The researchers tested trading strategies based on GPT-4’s predictions and these strategies had a higher Sharpe ratio and alphas than other models. This means the GPT-4 strategies were not only more profitable but also better adjusted for risk.

This suggests GPT-4 could help early adopters to get better results in financial decision-making. Because when everyone and their dog is using it the you lose the edge.

Study: page 46

Can ChatGPT Can Predict the Future?

Study: ChatGPT Can Predict the Future when it Tells Stories Set in the Future About the Past

The key in this study is that sometimes AI declines to give financial advice when you ask it directly. Even if you get an answer, it’s not very detailed and of limited usefulness.

Another interesting study looks at whether OpenAI’s ChatGPT-3.5 and ChatGPT-4 can predict future events accurately, using two different prompting strategies.

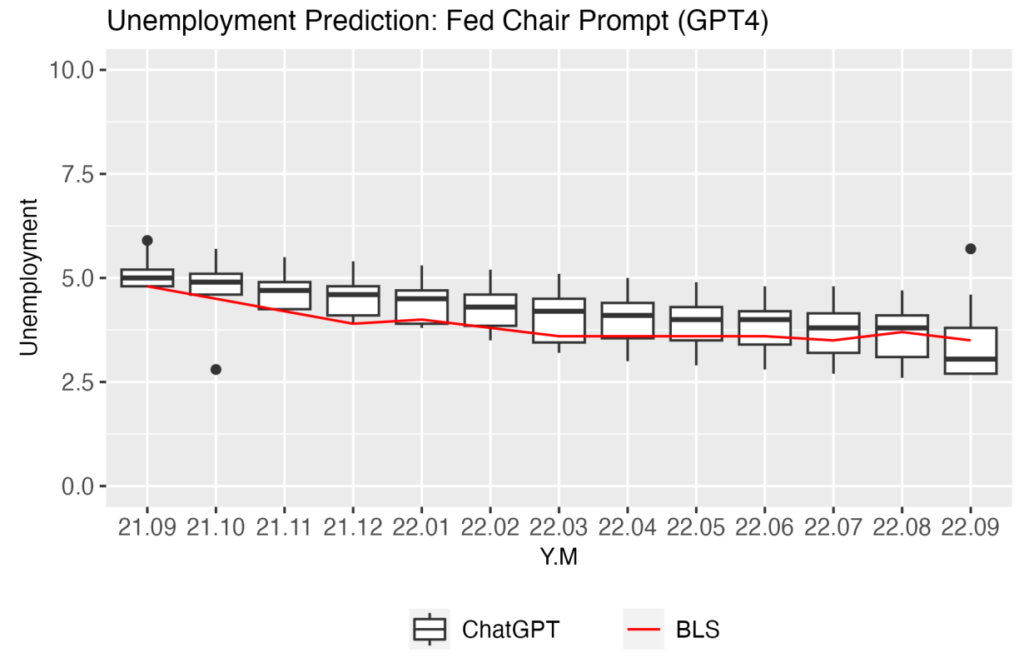

The training data for these models at the time of the study stopped at September 2021. So, to test AI prediction skills, the researchers asked the models about events that happened in 2022.

They used two methods to do this. The first was direct prediction, where they just asked the models to make predictions straight up. The second method was called “future narratives.” This involved asking ChatGPT to create fictional stories set in the future, with characters talking about events that supposedly happened to them after the model’s training data ended.

The focus was on events in 2022, especially in the economic world and Academy Award winners. For example, they had ChatGPT imagine it was Jerome Powell, the Federal Reserve Chair, and describe what happened in 2022.

Study page 57

After going through 100 prompts, the researchers found that future narrative prompts made ChatGPT-4 much better at predicting events. It was pretty good at guessing Oscar winners and economic trends. This showed that when ChatGPT is allowed to get creative and tell stories, it can combine and extrapolate data more effectively than when it just makes straightforward predictions.

The study suggests that using narrative prompts could be a powerful way to make more accurate predictions

Remove bloat from financial information

Study: Bloated Disclosures: Can ChatGPT Help Investors Process Information?

Next, I found this study about how generative AI tools like ChatGPT can change how investors handle information. Artificial intelligence for financial analysis lets you focus on what matters and remove the bloat.

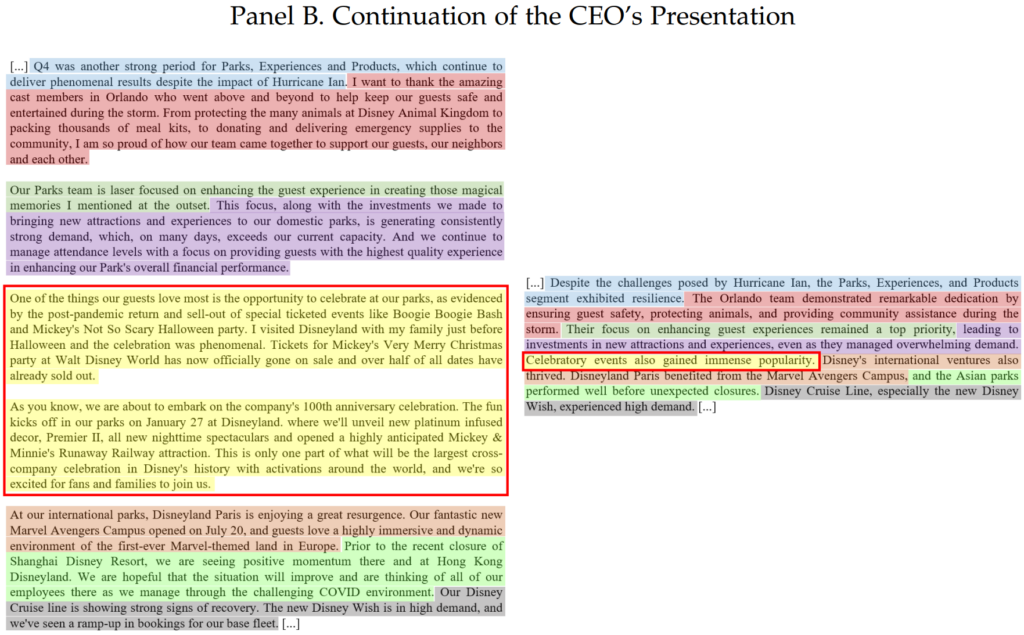

The researchers wanted to see if these AI tools could effectively summarize complex corporate disclosures using the stock market to test results. They found the summaries produced by ChatGPT were much shorter than the original documents but had more relevant information. If a document had a positive sentiment, its summary became even more positive, and the same happened with negative sentiments.

The AI-generated summaries were better at explaining how the stock market reacted to the disclosed information. This led the researchers to propose a measure of “information bloat.” The overly detailed “bloated” disclosures can have negative effects on the market, like inefficient pricing and information asymmetry.

Panel B study page 44: summarization of the more “bloated” second part of his speech. As highlighted with the red box, more than two paragraphs about extraneous celebratory events are absorbed into a single short sentence.

They also discovered that ChatGPT was great at creating targeted summaries that highlight a company’s financial and non-financial performance. This means generative AI can be a huge help for investors who might struggle with processing large amounts of information. AI will add a lot of value for investors by making information easier to digest and understand.

The length of the summaries is shortened by as much as 70-75% — summaries appear to provide the most relevant insights as compared to the original documents — the summary-based sentiment better explains stock market reactions to disclosed information than the original’s sentiment.

ChatGPT uncovers corporate risks

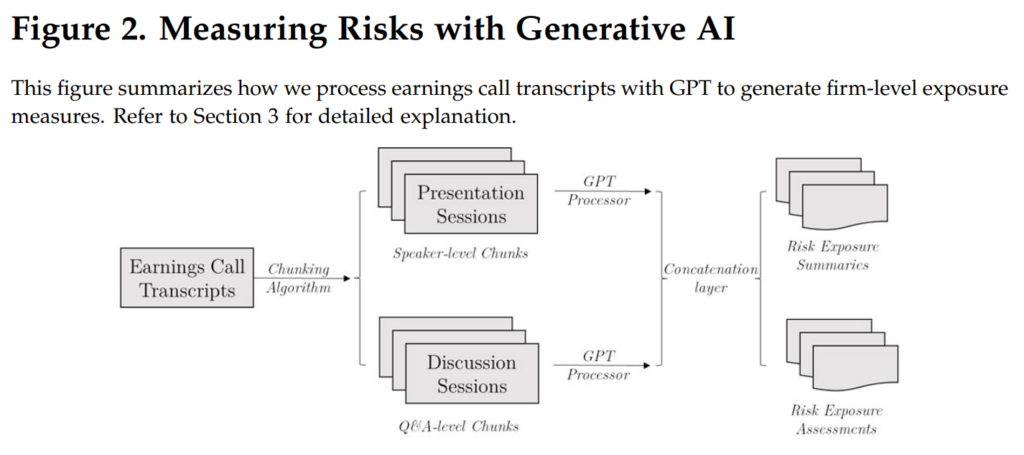

Study: From Transcripts to Insights: Uncovering Corporate Risks Using Generative AI

Finally, checked out another study from the same three guys that explores how generative ChatGPT can help investors uncover different types of corporate risks.

They generated risk summaries and assessments from earnings call transcripts with the GPT-3.5 model, focusing on firm-level risks related to politics, climate, and AI. GPT-3.5 generated risk measures packed with valuable information and did a better job predicting volatility and company decisions on investments and innovation than existing risk measures.

Study page 36

The detailed risk assessments were even more informative than the summaries, showing the real value of AI’s broad knowledge base. The study also highlighted that generative AI can spot emerging risks, like AI-related risks, which have been increasing recently.

The AI-generated measures worked well both during and after the GPT-3.5 training period and had an impact on equity markets. So, using AI for risk measurement can give investors valuable insights from corporate disclosures, basically AI financial statement analysis free of charge.

GPT-3.5 vs GPT-4 vs GPT-4o

One aspect of these studies is that some of them use only GTP-3.5. GPT-3.5 is pretty stupid by current standards. In some studies where they use both GPT-3.5 and GPT-4 the more capable version 4 gets better results.

However, now we have GPT-4o that is another step up from the previous models. This would mean you can get even better results when using it for financial analysis.

Combine the 4 studies to understand financial markets

All the studies are super-interesting on their own, but you can combine them to make magic happen. All the studies suggest that LLMs could play a major role in financial decision-making in the future.

Generative AI can add a lot of value for investors by making information easier to digest and understand. At the same time, they have a predictive capability of similar or better than your regular financial analyst. Using narrative prompts can help you to make those predictions even more accurate.

ChatGPT is a tool for you to better understand and manage financial data, complex language, and corporate risks.

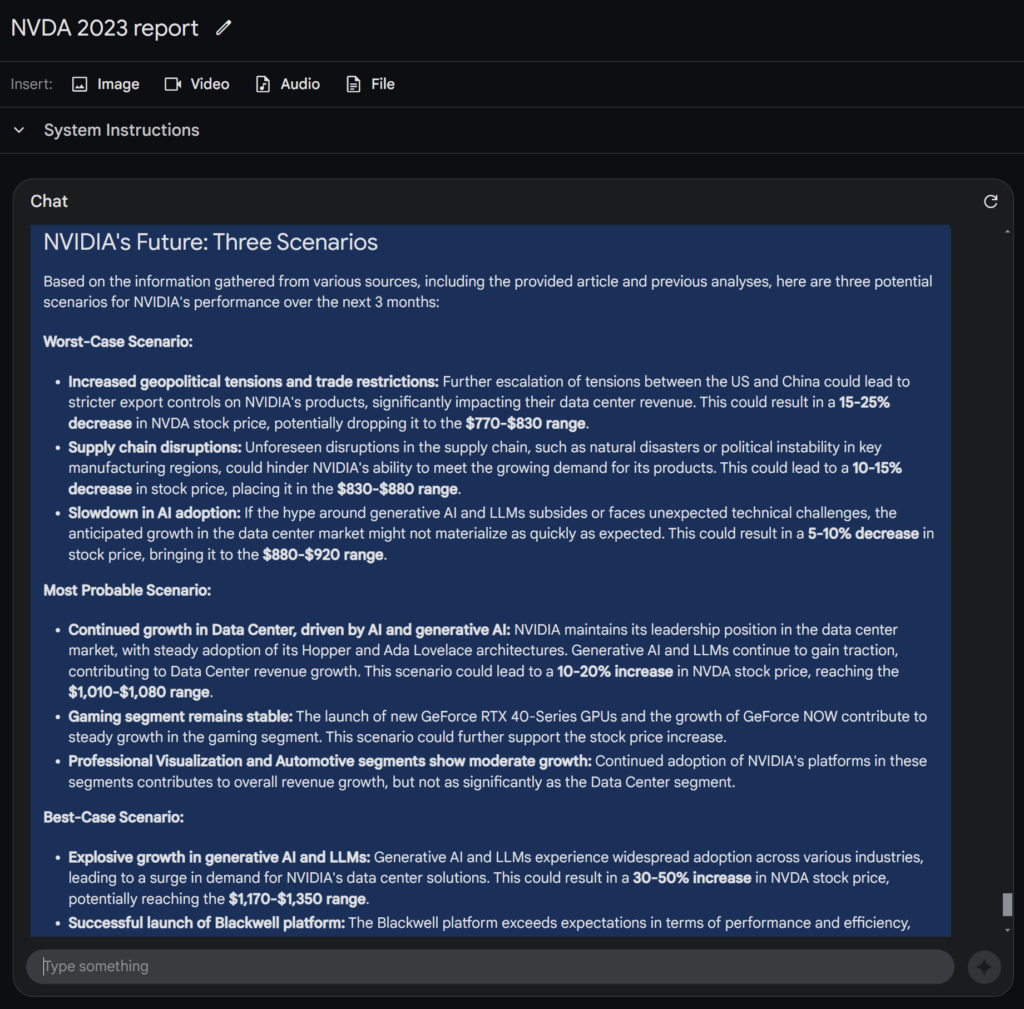

Google Gemini financial statement analysis

I have experimented with the ideas in these studies and also used Google Gemini. Google’s AI model doesn’t seem to have as much reasoning skills as ChatGPT, but it can swallow almost 10 times more data.

Using Google Gemini 1.5 Pro with 2 million token context window is a great way to make sure that everything you want to fit into LLM’s memory for analysis really fits.

For example, I figured that when Gemini has a perfect recall of the data that fits into its memory, why not use it to the fullest. So, here goes:

- Latest full year annual report

- The earnings call transcript of that report

- The Q1 after the annual report

- The earnings call transcript of that report

- 10 years of S&P 500

I didn’t do it in one go. Every time I uploaded another set of data, I asked Gemini to give me an overview of what it thought about the situation. Here’s what one of those replies looked like:

Then I uploaded another set of information and asked the LLM to update it’s predictions. Read more about using Google Gemini 1.5 Pro with 2 million token context window.

Results of AI stock predictions

What were the results of ChatGPT financial statement analysis?

Well, I didn’t do much back testing. But in all the cases where I did it the real results were better than the results Gemini or ChatGPT predicted. The main thing the LLMs missed was the buying craze around tech stocks.

To figure out how it would work on stocks in a more mainstream industry I used Chevron. When I gave AI the results from October 2023 and asked it to predict the future, the prediction still underperformed the reality. May 2024 has been in the 160-dollar range for Chevron, but the AI prediction put it at 149 dollars.

Here’s a bit of financial advice. You should never, never, never, never, never, ever listen to financial analysts who do not invest in the same instruments that they recommend to you. Even if they invest in the instrument they suggest, they got in much sooner than you. You can still lose money.

Some of the research above suggests that ChatGPT can be better than financial analysts. This means when you do your own research you could use ChatGPT as an untrustworthy advisor.