AI has been used by large corporations for many years now. But artificial intelligence has been mostly hidden from public view. One of the most important developments in 2022 was the release of ChatGPT to the general public. Now it could be the best time to start investing in AI stocks.

PS This is not an investment advice, just as I see things playing out. Do your research and consult professionals.

If your work involves coming up with ideas and solving problems, you will see a lot of change in the next couple of years.

Let’s take a look at what businesses can get the most out of improvements in artificial intelligence and what drives the share prices. You can also follow some of these businesses on Twitter.

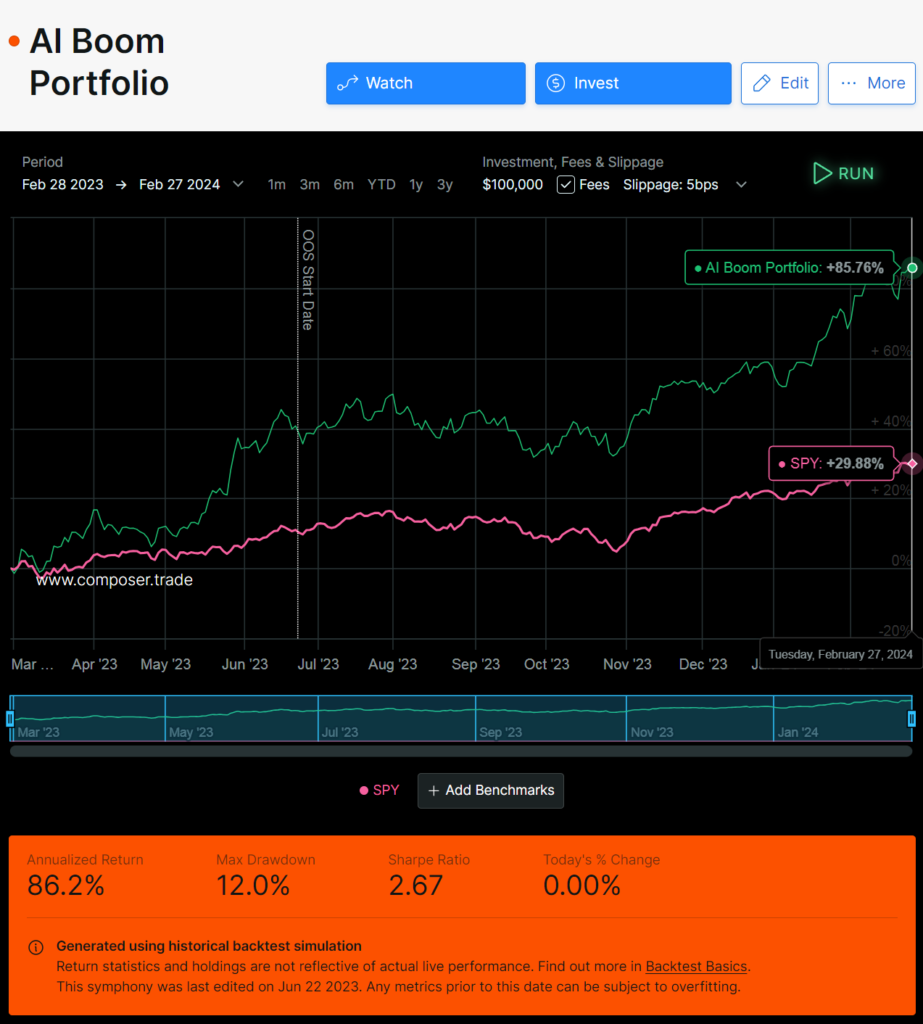

You can check the live portfolio here https://app.composer.trade/symphony/pbvScFcYMJzuZAgzSGy3/details

- MSFT

- NVDA

- META

- GOOG

- AMZN

- ADBE

- CRM

- IBM

- TSM

- ASML

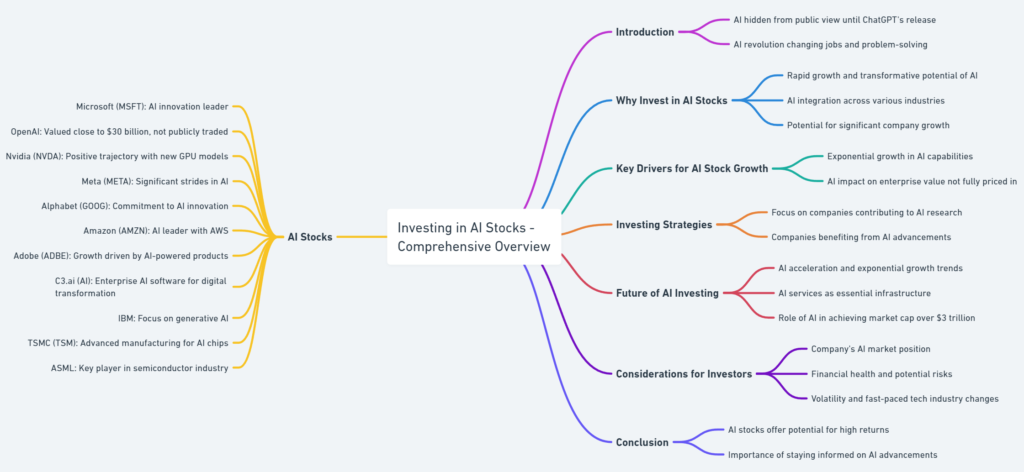

Investing in AI stocks mind map

Using ChatGPT financial statement analysis could help you sort out what to expect from these companies. However, it seems AI is a bit on the cautious site.

Investing in AI stocks: Technology companies

Tech companies are AI natives. Most of them have been using AI internally for years. Most of them are the main contributors to artificial intelligence research. You would think this means that the benefits of AI are already priced into their enterprise value.

I don’t think so!

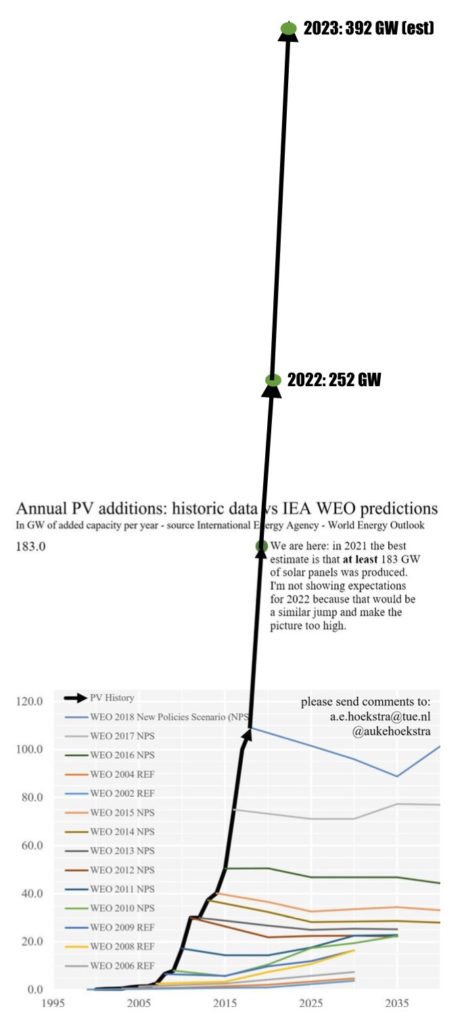

Here’s why. People are really bad at noticing exponential growth in real time. Even when we look back and see exponential growth, when we plan for the future, we think everything will be the same. Here’s a real-world example how people predict exponential trends

Source: https://www.lunarmobiscuit.com/exponential-growth-is-hard-to-predict/

In the case of artificial intelligence, it is essential to understand that growth is unbelievably fast.

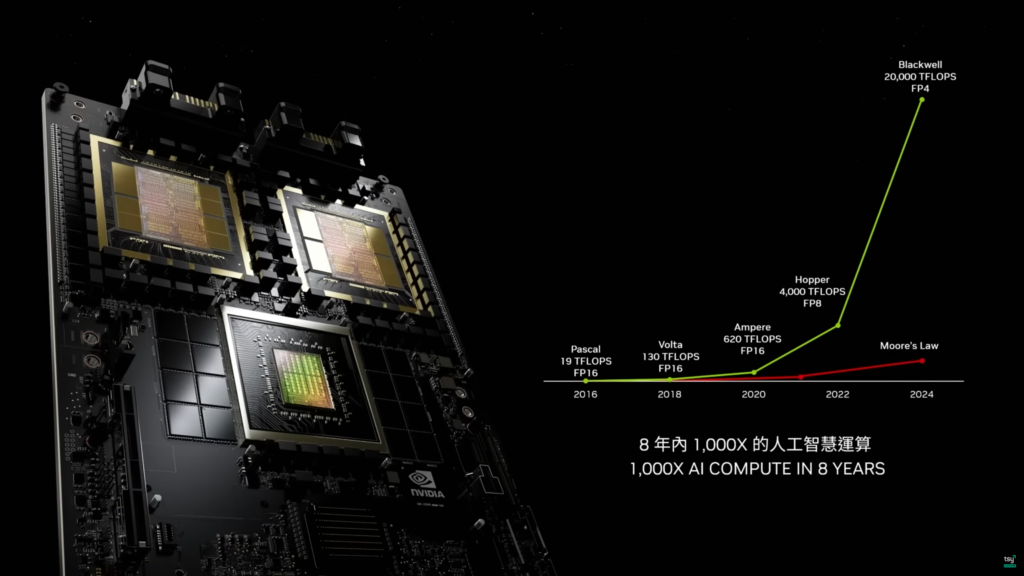

Moore’s law says that computers get two times faster in two years. Even if AI would get more power just from the computers, it would double every two years.

But that’s not all!

Human thinking and improvements in AI algorithms make the capability increase every six months. This means that during the time it takes computers to get two times faster, AI capabilities will increase 16 times. Multiplying that with the doubling of processor speeds, we get that in 2 years, AI will get 32 times more powerful. Or in other words, if you need 10 million dollars today to create an AI system, it would cost about 5000 dollars after five years.

Or in yet another angle. For the price of current systems, you would get an AI that is one thousand times more powerful.

The acceleration is accelerating!

Here’s a graph of Nvidia processor improvements.

You may know that exponential growth bends upwards on the linear graph, but on an exponential graph, it’s a straight upward line. Now the line is bending up even on the exponential scale.

Most likely, we have not priced in the value of the accelerating exponential growth into the stock prices of top technology companies.

Even the P/E values seem insane, but they may be insanely cheap considering the next 5 to 10 years.

Now, the AI acceleration accelerates, we have a double exponential growth. I came up with a symbol that would illustrate the concept nicely AI2. The symbol includes AI, but it also includes the second power means that acceleration is speeding up. It’s not technically correct, but a good way to illustrate the concept.

But it’s not just the big players who can benefit from the AI boom. Check out our artificial intelligence consulting services.

Largest AI companies

Then there are the special types of businesses that specialize in artificial intelligence technology. Organizations like OpenAI. These businesses build AI systems for others. Similarly, to Amazon Web Services owning IT infrastructure that it rents out to other businesses, there will be Amazon AI Services that rent out artificial intelligence to other businesses.

Some IT infrastructure companies could switch to providing AI cloud services. For example, Cloudflare, Oracle, and IBM.

These businesses could develop their own AI systems or work with artificial intelligence researchers to scale their AI tools globally. These businesses would be very good at running hardware infrastructure, and the competitive advantage would probably be just economies of scale.

When they are good at using AI to improve their processes, it will lead to a positive feedback loop that might make them outpace expectations.

Here you can check out the Twitter accounts of the largest AI companies.

OpenAI stock / ChatGPT stock

OpenAI stock is not publicly traded. ChatGPT stock is not publicly traded. OpenAI, the owner of ChatGPT, is a private company. It’s not on any stock market exchange.

At a recent conference in Abu Dhabi, Sam Altman, the Chief Executive of OpenAI, stated their position clearly. The Microsoft-supported company, which developed ChatGPT, is not preparing for a public offering in the near future.

“When we develop super intelligence, we are likely to make some decisions that most investors would look at very strangely.”

Sam Altman

So far, OpenAI has managed to secure $10 billion in funding from Microsoft. This places the company’s valuation close to $30 billion as it continues to expand its investment in computing capabilities.

What company owns OpenAI? OpenAI has a variety of investors such as Microsoft, Khosla Ventures, Reid Hoffman, and a few others. As it’s a private company, they haven’t released specific details about who owns what.

Microsoft, MSFT

This year, MSFT continues to be a dominant player in the tech industry, with a particular emphasis on artificial intelligence (AI). The company’s commitment to AI innovation is evident in its numerous initiatives and investments in this field, which are expected to drive growth and solidify its market position.

Artificial intelligence-driven gains can propel Microsoft Corp. to join Apple Inc. in the elite category of stocks with a market capitalization of more than $3 trillion.

Morgan Stanley via Fortune

Microsoft’s AI driver is the exclusive deal with OpenAI.

Microsoft’s AI capabilities are being integrated across its product portfolio, enhancing offerings in cloud computing, business analytics, and productivity tools. This has led to increased adoption by businesses seeking to leverage AI for operational efficiency and strategic insights.

In terms of financial performance, Microsoft has shown steady growth in the last quarters.

Looking ahead, Microsoft’s continued investment in AI, coupled with its robust financial performance, suggests a promising future for its stock. The company’s ability to innovate and adapt to market trends, as well as its strong financial health, make it a potentially attractive option for investors. However, as with any investment, potential investors should conduct their own research and consider their risk tolerance and investment goals.

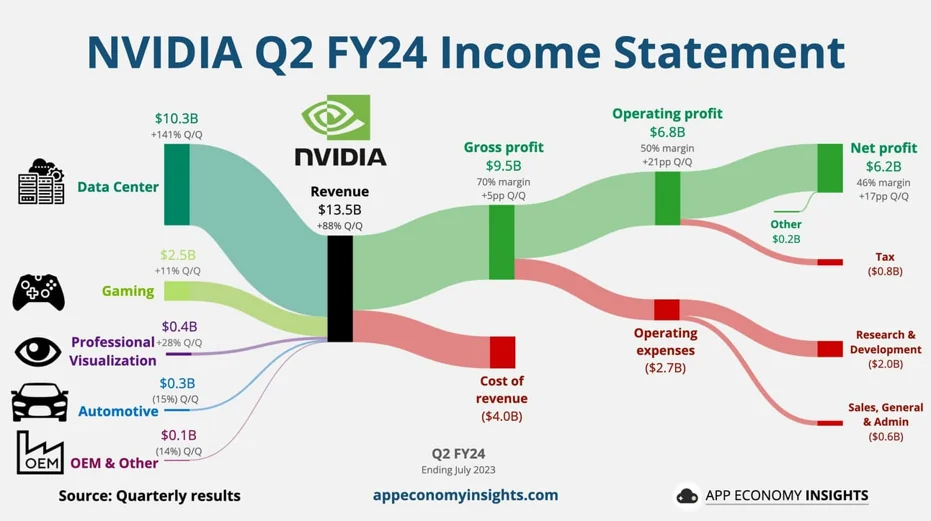

Nvidia Corp, NVDA

The future of NVDA, particularly with a focus on its GPUs, appears to be on a positive trajectory. Nvidia is set to launch new GPU models, including ‘Ampere Next Next’ in 2024, which are expected to further solidify the company’s position in the market.

The company has seen a steady increase in its stock price. This upward trend reflects the market’s positive response to Nvidia’s strategic moves and technological advancements in the GPU sector.

Moreover, Nvidia’s optimism about GPU supplies, backed by increased investments in manufacturing, is likely to boost GPU availability and potentially drive further growth in the company’s stock.

Meta, META

META, formerly Facebook, continues to make significant strides in the realm of artificial intelligence (AI). The company’s commitment to AI innovation is evident in its numerous initiatives and investments in this field, which are expected to drive growth and solidify its market position. In terms of financial performance, Meta has shown steady growth, the company’s stock price reflects a positive trend.

Looking ahead, Meta’s continued investment in AI, coupled with its robust financial performance, suggests a promising future for its stock. They develop a Llama 3 LLM. The company’s ability to innovate and adapt to market trends, as well as its strong financial health, make it a potentially attractive option for investors. However, as with any investment, potential investors should conduct their own research and consider their risk tolerance and investment goals.

Alphabet Inc, GOOG

Alphabet Inc (GOOG) is making big moves in artificial intelligence (AI). In Q2 2024, Alphabet’s total revenue hit $84.7 billion, up 14% from last year. The stock price is stable, showing steady growth.

Here are some key points about Alphabet’s AI progress:

- Gemini 1.5 Pro AI: Alphabet introduced Gemini 1.5 Pro AI with a 2 million token context window, aiming to compete with OpenAI.

- Google Cloud Growth: Google Cloud earned over $10 billion in revenue this quarter, with a $1 billion operating profit. This is a 29% increase, driven by AI solutions used by over 2 million developers.

- Enhanced Search: AI improvements in Google Search increased user engagement, especially for ages 18-24. AI Overviews made search responses better, leading to higher satisfaction.

For potential investors, Alphabet’s AI innovations and strong financial health make it a promising option. However, investing in tech always has risks. Market conditions change, and new tech can be unpredictable. Always do your research and consider your risk tolerance before investing.

Alphabet is growing and innovating in AI, which is great for the company’s future. But, like any investment, it’s important to think about the risks and make informed decisions.

Amazon.Com Inc, AMZN

AMZN continues to be a big player in the AI space, with its cloud computing platform, Amazon Web Services (AWS), leading the charge. AWS offers a comprehensive suite of AI services and tools that cater to various business needs, from machine learning to natural language processing. This has been highlighted by analysts such as Morgan Stanley’s Brian Nowak, who emphasized the rapid pace of AI innovation within AWS and its full AI tech stack.

Moreover, Amazon’s financial performance has been robust. The company’s stock price has seen a steady increase.

However, Amazon’s future is not without challenges. The company’s AI development is heavily tied to its cloud services, which face stiff competition from other tech giants like Microsoft and Google.

Despite these challenges, Amazon’s continued investment in AI and its strong financial performance suggests a promising future for its stock. The company’s ability to leverage AI to drive innovation and efficiency across its vast ecosystem of services will likely continue to provide a competitive edge and fuel its growth in the coming years.

AI technology has the potential to benefit AMZN’s product development, marketing, sales, operations, finance, human resources, and social responsibility practices. For example, natural language processing, computer vision, generative AI, and quantum machine learning could improve the quality of AMZN’s products and services. AI-powered data analytics, personalization, and recommendation systems could optimize marketing and sales strategies, while automation, robotics, forecasting, and fraud detection could streamline operations and finance functions.

Adobe, ADBE

ADBE is poised to continue its growth trajectory, largely driven by its AI-powered products and services. Adobe’s AI platform, Adobe Sensei, has been a game-changer in the creative software industry, offering features like auto-tagging and advanced image editing, which are integrated across Adobe’s suite of products. This has not only improved the user experience but also increased efficiency for professionals in the creative industry.

Adobe’s continued investment in AI and machine learning technologies, coupled with the increasing demand for creative software solutions, is expected to drive the company’s growth. The company’s focus on innovation and its robust product portfolio, including Adobe Creative Cloud, Document Cloud, and Experience Cloud, will likely contribute to its market position and financial performance.

AI technology will significantly impact ADBE’s business operations. Generative AI will be used to enhance Creative Cloud apps and Adobe Express, facilitating creative brainstorming and exploration for artists. Sensei-powered features such as Neural Filters, Sky Replacement, and Content-Aware Fill will enable maximum creativity and precision across ADBE’s products.

Salesforce, CRM

CRM stock is expected to rise in the next 12 months, driven by its AI enhancements via Salesforce Einstein. This platform’s ability to personalize customer interactions, streamline sales and marketing efforts, and boost operational efficiency positions Salesforce as a key player in the tech-driven business landscape. The increasing demand for data-driven solutions further solidifies its market position, promising revenue growth. Salesforce’s commitment to AI innovation makes it an attractive investment for those looking to capitalize on the tech sector’s growth.

Salesforce Einstein, the AI platform within Salesforce, is revolutionizing sales, marketing, customer service, and analytics by introducing predictive analytics and automation. Here’s a concise overview of its impact:

- Sales: Einstein prioritizes leads that are more likely to convert, making sales efforts more targeted and increasing productivity.

- Marketing: It personalizes marketing efforts by predicting customer preferences, ensuring messages are timely and relevant across channels.

- Customer Service: AI automates case routing and suggests solutions, speeding up response times and improving customer satisfaction.

- Forecasting: Einstein offers accurate sales and market trend forecasts, aiding strategic planning and decision-making.

- Efficiency: By automating repetitive tasks, it allows teams to focus on higher-value activities, enhancing overall efficiency.

In essence, Salesforce Einstein is enabling businesses to be more customer-centric and data-driven, streamlining operations and fostering better customer relationships.

IBM, IBM

IBM continues to make significant strides in the field of AI, with a particular focus on generative AI. The company’s AI research division has been at the forefront of developing innovative AI technologies, including Project Debater, an AI system that can engage in live debate with humans, and AI FactSheets, a framework for increasing transparency in AI systems. These advancements have positioned IBM as a leader in the AI space and have contributed to the company’s financial performance.

Looking ahead, IBM’s continued investment in AI and its commitment to developing advanced generative AI technologies are expected to drive the company’s growth. The company’s focus on AI-driven applications for industries like healthcare, finance, and cybersecurity, among others, will likely contribute to its market position and financial performance.

Taiwan Semiconductor Manufacturing Ltd, (TSM)

TSM, the world’s largest dedicated independent (pure-play) semiconductor foundry, is poised for continued growth, driven by its innovative AI products and services. TSMC’s advanced manufacturing processes, including its 3nm and 2nm technology, are pivotal in the production of high-performance AI chips used in various applications, from data centers to autonomous vehicles.

Looking ahead, TSMC’s continued investment in AI and its commitment to advancing semiconductor technology are expected to drive the company’s growth. The company’s focus on AI-driven applications for industries like automotive, high-performance computing, and IoT, among others, will likely contribute to its market position and financial performance.

ASML Holding NV, ASML

ASML, a leading supplier of photolithography systems for the semiconductor industry, is poised for continued growth, driven by its innovative products and services. ASML’s advanced lithography machines, which are critical in the production of high-performance chips used in AI applications, have positioned the company as a key player in the semiconductor industry.

Looking ahead, ASML’s continued investment in research and development and its commitment to advancing lithography technology is expected to drive the company’s growth. The company’s focus on AI-driven applications for industries like automotive, high-performance computing, and IoT, among others, will likely contribute to its market position and financial performance.

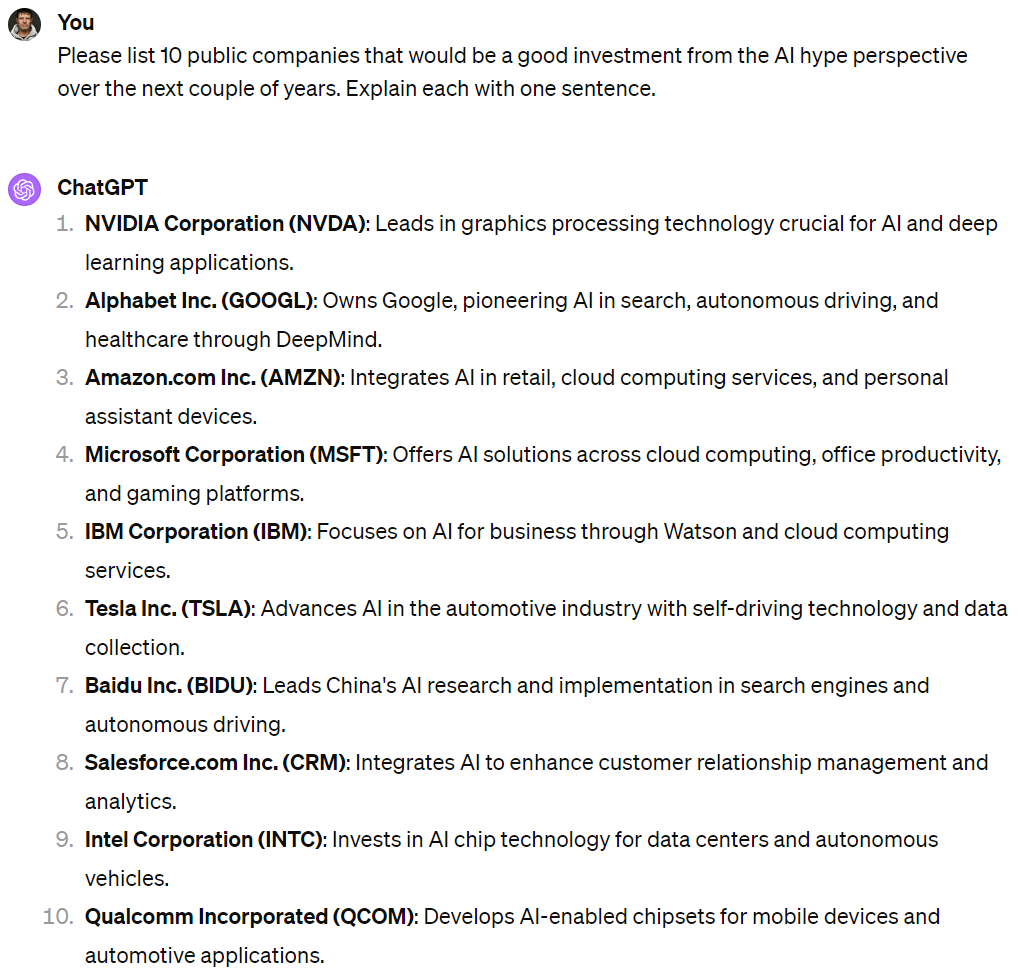

What ChatGPT suggested for investing in AI stocks?

Finally, I asked ChatGPT to make its list of AI stocks. It differs by on position. I don’t have AMD on the list instead I have Meta which will probably get more value out of AI. Provided Zuck doesn’t go crazy as he did with the metaverse.

Why is investing in AI stocks considered a smart move?

Investing in AI stocks is considered a smart move due to the rapid growth and transformative potential of artificial intelligence. AI is being integrated into a wide range of industries, from healthcare to finance, driving efficiency and innovation. As a result, companies that are leaders in AI are poised for significant growth, making their stocks potentially lucrative investments.

What are some potential benefits of investing in AI stocks?

One of the key benefits of investing in AI stocks is the potential for high returns. As AI continues to evolve and become more integrated into our daily lives, companies at the forefront of this technology stand to gain significantly. Additionally, investing in AI stocks allows investors to diversify their portfolios and participate in the growth of one of the most innovative sectors of the economy.

How does the future of AI technology look like, and how does it impact the decision to invest in AI stocks?

The future of AI technology looks incredibly promising, with advancements being made at a rapid pace. AI is expected to become more sophisticated and integrated into a variety of sectors, from healthcare to finance to transportation. This widespread adoption and continuous innovation make AI stocks a potentially smart investment, as companies leading in this space are likely to experience significant growth.

What should investors consider when investing in AI stocks?

When investing in AI stock, consider the company’s position in the AI market, the practical applications of its AI technology, and its overall financial health. It’s also important to consider the potential risks, as with any investment. Despite the potential for high returns, AI stocks can also be volatile and subject to fast-paced changes in the tech industry.