Banks face constant pressure to evolve or risk falling behind. Generative AI in banking isn’t just helping banks keep up, it’s pushing them forward. With the ability to add $200–$340 billion annually, AI is more than a tool, it’s a revenue driver. Whether it’s streamlining operations, enhancing customer experiences, or reducing risk, the benefits are tangible and immediate.

But it’s not just about money. Generative AI is transforming the entire banking experience. From cutting customer support costs by up to 50% to speeding up credit decisions from weeks to hours, this technology delivers faster results and stronger outcomes. In a world where time and trust are everything, banks that adopt AI aren’t just surviving, they’re leading.

Find out generative AI is shaping the future of financial services.

1. Artificial Intelligence Economic Impact in Banking

Generative AI is adding between $200 and $340 billion to the banking industry annually. That’s 3–5% of the entire sector’s revenue. This value comes from smarter decision-making, faster customer service, and better resource use. Banks that adopt generative AI move ahead, leaving slower competitors behind.

Profitability jumps when banks use generative AI. Profit increases of 9–15% are already being reported by institutions leveraging this technology. This isn’t just about reducing costs; it’s about making every process more effective. From credit decisions to fraud detection, AI-driven insights cut time and increase returns.

Why does this matter to you? If your bank isn’t already tapping into these tools, you’re leaving money on the table. AI isn’t just an option, it’s the way to grow faster and smarter. Ready to see how AI impacts customer experience? Read the next section for details.

2. AI Customer Service in Banking

Generative AI is driving the majority of innovation in customer service. An incredible 90% of AI research targets better customer interactions, focusing on tools like chatbots and virtual assistants. These systems aren’t just about answering questions, they’re about personalized, 24/7 support that matches your customers’ needs. This kind of engagement keeps customers coming back.

Generative AI isn’t just improving service, it’s slashing costs. Customer support expenses drop by 30–50% when banks use AI-powered tools. Imagine fewer manual processes and faster resolutions, all while saving money. That’s the kind of efficiency that directly impacts your bottom line.

Why does this matter? Better service leads to loyal customers, and lower costs mean more resources for growth. Want to learn how these tools are reshaping operational efficiency? Stick around for the next section.

3. Generative AI and Operational Efficiency in Banking

Generative AI is transforming how banks handle repetitive tasks. By automating workflows, banks see a 20–30% increase in employee productivity. Staff can now shift focus from manual, time-consuming processes to high-impact strategic work. This isn’t just about saving time, it’s about improving how teams contribute to growth.

Content creation is faster than ever. Generative AI cuts the time spent on reports and marketing materials by 50%. What once took hours can now be done in minutes, freeing resources for more critical projects. This isn’t a small improvement, it’s a fundamental shift in how banks operate.

Why does this matter? When you save time and money, you create space for innovation. Want to know how AI helps banks deliver personalized customer experiences? Keep reading to find out.

4. Generative AI in Banking in Financial Decision-Making

Generative AI significantly improves credit risk assessments. Some banks have reported 40% fewer errors in their predictive models. This higher level of accuracy means fewer defaults and better credit decisions, protecting the bank’s bottom line. It’s precision that directly impacts profitability.

Decision-making isn’t just more accurate, it’s faster. Generative AI reduces credit approval times from weeks to hours. This speed lets banks respond to customer needs quickly, improving satisfaction while staying ahead of competitors. Faster decisions mean more business closed in less time.

Why does this matter? Accuracy and speed in financial decisions directly improve customer trust and operational efficiency. Curious about how AI boosts fraud detection and security? Stay tuned for the next section.

5. Trust and Ethical Challenges

Data privacy is a growing concern for customers. 38% of customers are hesitant to use AI-driven services because they fear how their data will be handled. This isn’t just about perception, it’s a real barrier to adoption that banks need to address. Customers want to know their data is safe and used responsibly.

The problem isn’t limited to customers. In developing economies, only 25% of banks have strong generative AI frameworks. This means most banks are not fully prepared to handle the ethical and operational issues AI can bring. Without proper systems, these banks risk losing customer trust and facing regulatory backlash.

Why does this matter? Trust is the foundation of banking. Building strong frameworks for data privacy and transparency is critical to earning customer confidence. Interested in how AI improves operational efficiency while staying compliant? Read on to the next section.

The disadvantages of AI in banking are real and can impact your day-to-day work. From high implementation costs to potential job displacement, understanding these downsides is crucial for anyone in the banking sector.

6. Generative AI in Financial Analysis

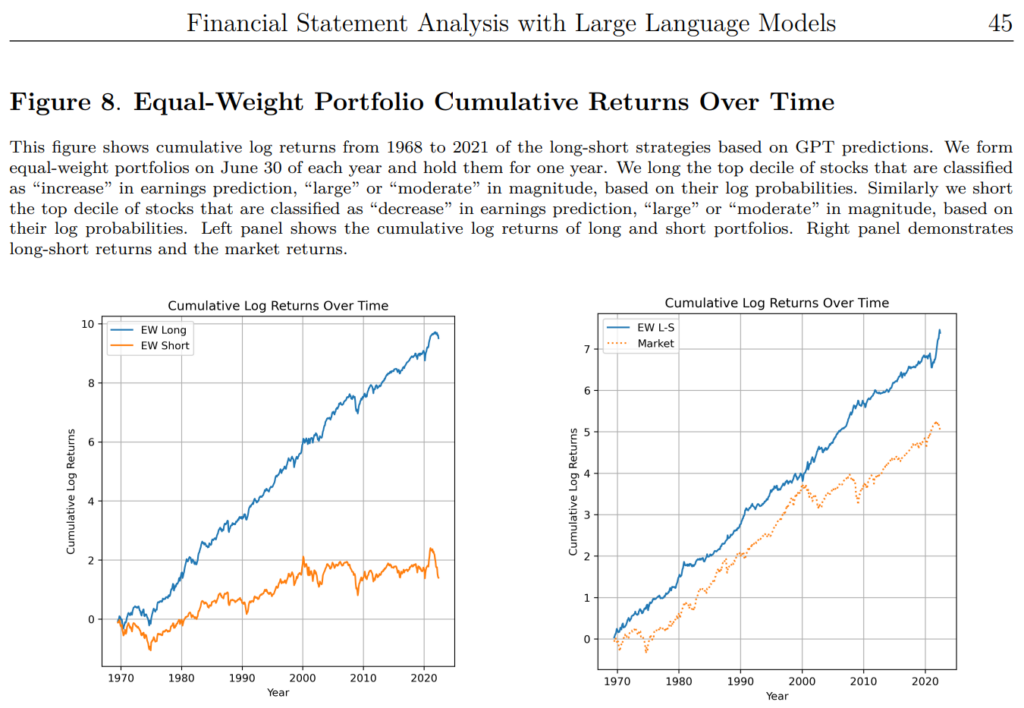

Generative AI is redefining financial analysis by delivering accurate and efficient insights. GPT-4 outperforms human analysts in predicting earnings changes, achieving higher accuracy than specialized machine learning models. It reduces financial disclosures by 70–75%, offering concise summaries that better explain stock market reactions compared to original documents. AI-generated risk assessments predict market volatility and corporate decisions more effectively, focusing on political, environmental, and technology risks. Adoption is growing, with 35% of Brits planning to use AI for financial advice in 2024, up from 27% in 2023. JPMorgan’s AI tool, valued at $1–1.5 billion, is used by 15% of employees to improve research and streamline tasks. Google Gemini 1.5 Pro, with its 2 million-token context window, further enhances analysis by integrating large datasets, making it a key tool for financial professionals.

Future Potential of Generative AI in Banking

Generative AI adoption in banking is accelerating. With a projected compound annual growth rate (CAGR) of 37.3% from 2023 to 2030, the technology is set to redefine how banks operate. This rapid growth means more banks will integrate AI into everyday processes, staying competitive and meeting customer expectations.

Fraud detection is one of the biggest wins. Banks using generative AI report fraud reduction rates of 50% or more. This level of accuracy helps protect customer assets, reduces losses, and strengthens trust in financial institutions. It’s a significant step toward safeguarding banking operations.

Why does this matter? Generative AI is not just an upgrade, it’s the future of secure and efficient banking. Want to see how these innovations are improving customer satisfaction? Check out the next section.

The Future Generative AI in Banking

Generative AI is rewriting the rules of banking. It’s driving $200–$340 billion in value annually, boosting profits by up to 15%, and transforming customer interactions with tools that are smarter, faster, and more cost-effective. From reducing credit approval times to cutting customer service costs by 50%, AI is helping banks achieve more with less.

The future is clear: banks that start using generative AI lead in efficiency, security, and trust. They’re not just adapting, they’re setting new standards for what’s possible. Whether it’s delivering better financial decisions or protecting customers from fraud, AI is becoming the foundation for growth and resilience.

Ready to move your bank forward? Start exploring how generative AI can streamline your processes, enhance customer loyalty, and secure your competitive edge. Your next step is waiting. Let’s take it together.